News

MTAC Supporting Wreaths Across America

Through this effort, we will be working to fill one trailer load of sponsored veterans’ wreaths to send to Arlington National Cemetery this December.

Read MoreConnecticut HUT revenue lower than expected

Connecticut’s highway use tax on trucks traveling throughout the state is off to a slow start, and revenues are lower than first estimated.

Read MoreFMCSA removes popular device from approved list

The FMCSA has placed another Electronic Logging Device – All-Ways Track ELD – on the agency’s list of revoked devices.

Read MoreConnecticut’s Highway Use Tax – Using honor system

Connecticut’s Highway Use Fee took effect on Jan. 1 with the first reports due at the end of January. There is confusion and anger concerning the new tax.

Read MoreIs the New England grid ready for electric trucks?

While the Northeast is ramping up efforts to electrify diesel-powered truck fleets, the region lacks a vision for what the increased electricity demand will mean.

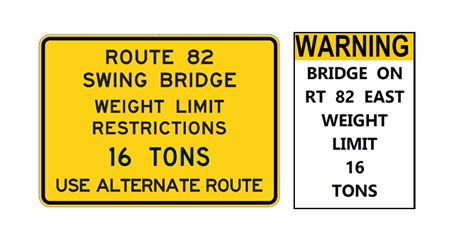

Read MoreWeight restrictions during East Haddam swing bridge overhaul

Any truck that exceeds 16 tons is restricted from using the East Haddam Swing Bridge. Spread the word about the restrictions!

Read MoreMTAC Buyers Guide

Strategic Value Media (SVM) was selected as the exclusive publisher and advertising sales agent of the Motor Transport Association of Connecticut Buyers’ Guide.

Read MoreBill Tracker – as of Jan. 26, 2023

MTAC is closely tracking and sharing legislation of interest with you. See the bills below that we are already tracking.

Read MoreBill Tracker – as of Jan. 1, 2023

MTAC is closely tracking and sharing legislation of interest with you. See the bills below that we are already tracking.

Read MoreFMCSA fine rate increases for 2023

The fine rate increases are part of an annual adjustment to account for inflation. It is required by federal legislation passed in 2015.

Read More