MTAC submits testimony on Act Concerning Revenue Items to Implement the Governor’s Budget

MTAC President Joe Sculley submitted testimony this week in response to a bill implementing the Governors proposed budget for 2021. This year’s budget includes the truck milage tax, which will impose a levy on trucks that is based on weight and milage traveled in the state. In the testimony Sculley gave a number of reasons…

MTAC President Joe Sculley submitted testimony this week in response to a bill implementing the Governors proposed budget for 2021. This year’s budget includes the truck milage tax, which will impose a levy on trucks that is based on weight and milage traveled in the state.

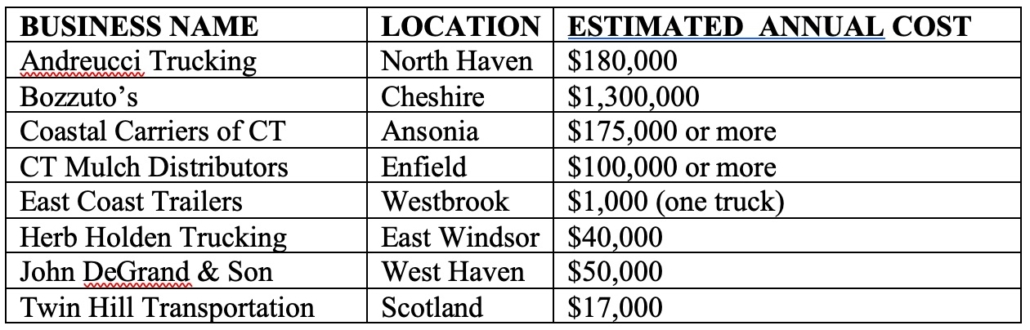

In the testimony Sculley gave a number of reasons why MTAC opposes the bill and went on to say “In-state businesses will pay this tax, while out-of-state businesses will evade (not pay) it, either knowingly or unknowingly.” Sculley went on to list a number of MTAC members showing how much they will pay annually if lawmakers move forward with the bill.

Sculley then went on to say, “The trucking industry is the backbone of the American economy, it is comprised of small businesses, and provides good paying jobs for anyone who wants to work hard to earn a good living.”

The complete letter is available as a PDF and provided below.

Re: HB 6443 An act concerning revenue items to implement the governor’s budget

MTAC Opposes

Co-Chair Fonfara, Co-Chair Scanlon, Ranking Member Martin, Ranking Member Cheeseman, and members of the Finance, Revenue, and Bonding Committee, thank you for the opportunity to submit this testimony. My name is Joe Sculley, I am the president of the Motor Transport Association of Connecticut (MTAC), which is a statewide trade association representing small business trucking companies.

MTAC opposes this tax targeting our industry for the following reasons:

- In-state businesses will pay this tax, while out-of-state businesses will evade (not pay) it, either knowingly or unknowingly

- It will cost in-state trucking companies a lot of money. Here are some estimates that have been given to me:

- More details on the chart above can be seen in this video.

- It will most likely not generate the estimated $90 million annually;

- A weight-distance tax is expensive to administer, and easy to evade.

- 20 states have repealed weight-distance taxes because they don’t work (didn’t generate predicted revenue, weren’t enforced): AL, AZ, AR, CO, FL, GA, IA, ID, KS, MI, MN, NV, OH, OK, UT, TN, WI, WV, WY

- Studies by the American Transportation Research Institute (ATRI) estimate that New York’s weight-distance tax has an evasion rate of anywhere from 35% to 50%+

- Commissioner McCaw stated on Feb 10 that the tax would be on the “honor system,” and that the state would not hire additional enforcement personnel

- Connecticut won’t be able to leverage the federal funds the administration is discussing due to the likely shortfall in collected revenue

- It is not the trucking industry’s fault that more than $1 billion in fuel tax receipts were diverted and spent on non-transportation purposes over several years

- Truckers pay many taxes and fees that passenger cars do not.

- 12% Federal Excise Tax, Heavy Vehicle Use Tax, Federal Tire Tax, Unified Carrier Registration Fees, Federal diesel tax, International Fuel Tax Agreement (IFTA), International Registration Plan (IRP)

- The average 5-axle tractor trailer in Connecticut pays more than $17,000 annually in state and federal road taxes. The industry pays more than it’s fair share.

- Commercial trucking was deemed an “essential workforce” during the COVID-19 pandemic. The Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency (CISA) classified truck drivers as essential to the continued viability of our nation’s infrastructure for the duration of the pandemic. The state government agreed.

- The industry kept our country’s society going during the pandemic, and continued to pay road taxes while doing so. Most passenger car drivers did not travel, and thus did not pay many road taxes (fuel taxes). Now, trucking is being targeted to close a funding gap which it did not cause.

The legislature should consider implementing an electric vehicle fee, like 28 other states have done. Since electric vehicle owners do not buy gas and pay gas tax, they are not paying their fair share as far as funding the maintenance of our roads and bridges.

States with EV fees: AL, AR, CA, CO, GA, HI, ID, IL, IN, IA, KS, MI, MN, MS, MI, NE, NC, ND, OH, OR, SC, TN, UT, VA, WA, WV, WI, WY

The trucking industry is the backbone of the American economy, it is comprised of small businesses, and provides good paying jobs for anyone who wants to work hard to earn a good living. USDOT data shows that 97% of trucking companies operate 20 trucks or less. USDOL data shows that more than 40% of truck drivers are minorities. Public policy targeting small businesses, who employ a diverse group of people, would be an incredibly poor decision. I urge rejection of the truck mileage tax.

###

About the Connecticut Trucking Industry

- 85.8%: number of Connecticut communities that depend exclusively on trucks to move their goods

- 98%: percent of manufactured tonnage transported by truck in Connecticut

- $3.4 billion: total trucking industry wages paid in Connecticut (2018)

- 61,590: trucking industry jobs in Connecticut (2018)

- $55,777: average annual salary in Connecticut (2018)

- $9,026: average annual CT-imposed highway user fees paid by tractor trailers (as of 1/1/2020)

- $8,906: average annual fed-imposed highway user fees paid by tractor trailers (as of 1/1/2020)