HB 6539 testimony: CDL holders and pretrial alcohol education programs

MTAC President Joe Sculley submitted a second testimony this week in response to a bill concerning commercial driver’s license holders and pretrial alcohol education programs. The main reason MTAC opposes the bill, Sculley explained, is that “if enacted, this will violate federal regulation which will result in the loss of federal highway funds for the…

MTAC President Joe Sculley submitted a second testimony this week in response to a bill concerning commercial driver’s license holders and pretrial alcohol education programs.

The main reason MTAC opposes the bill, Sculley explained, is that “if enacted, this will violate federal regulation which will result in the loss of federal highway funds for the State of Connecticut.”

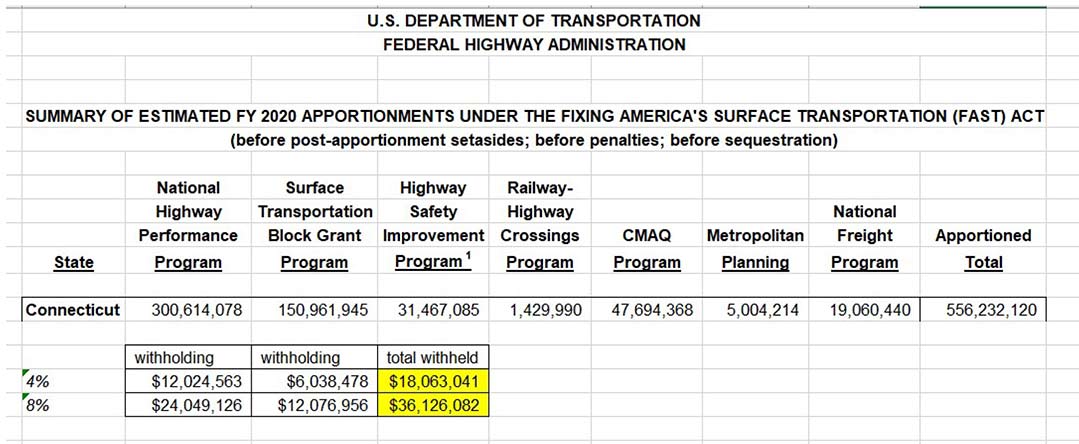

The testimony went on to say “Based on publicly available data showing highway funds apportioned under the federal FAST Act, after the first year of non-compliance with the federal regulation, about $18,063,041 in federal highway funds would be withheld from Connecticut. After the second year of non-compliance, $36,126,082 in federal highway funds would be withheld. These numbers are based on FY 2020 figures. They could increase if more funds are appropriated to Connecticut after the enactment of this bill.”

The complete letter is available as a PDF and provided below.

Re: Raised Bill 6539 — An Act Concerning Commercial Driver’s License Holders and Pretrial Alcohol Education Programs

MTAC Opposes

Co-Chair Stafstrom, Co-Chair Winfield, Ranking Member Kissel, Ranking Member Fishbein, and members of the Judiciary Committee, thank you for the opportunity to submit this testimony. I am Joe Sculley, president of the Motor Transport Association of Connecticut (MTAC), which is a statewide trade association representing small business trucking companies.

The main reason for MTAC’s opposition is that, if enacted, this will violate federal regulation which will result in the loss of federal highway funds for the State of Connecticut. Based on publicly available data showing highway funds apportioned under the federal FAST Act, after the first year of non-compliance with the federal regulation, about $18,063,041 in federal highway funds would be withheld from Connecticut. After the second year of non-compliance, $36,126,082 in federal highway funds would be withheld. These numbers are based on FY 2020 figures. They could increase if more funds are appropriated to Connecticut after the enactment of this bill.

The federal regulation that would be violated is 49 CFR 384.226.

49 CFR §384.226: Prohibition on masking convictions

The State must not mask, defer imposition of judgment, or allow an individual to enter into a diversion program that would prevent a CLP or CDL holder’s conviction for any violation, in any type of motor vehicle, of a State or local traffic control law (other than parking, vehicle weight, or vehicle defect violations) from appearing on the CDLIS driver record, whether the driver was convicted for an offense committed in the State where the driver is licensed or another State.

49 CFR §384.401 – Withholding of funds based on noncompliance

(a) Following the first year of noncompliance. An amount up to 4 percent of the Federal-aid highway funds required to be apportioned to any State under each of sections 104(b)(1), (b)(3), and (b)(4) of title 23 U.S.C. shall be withheld from a State on the first day of the fiscal year following such State’s first year of noncompliance under this part.

(b) Following second and subsequent year(s) of noncompliance. An amount up to 8 percent of the Federal-aid highway funds required to be apportioned to any State under each of sections 104(b)(1), (b)(3), and (b)(4) of title 23 U.S.C. shall be withheld from a State on the first day of the fiscal year following such State’s second or subsequent year(s) of noncompliance under this part.

Furthermore, the federal regulations cover additional considerations for a State found in “substantial noncompliance” under 49 CFR §384.405 – Decertification of State CDL Program. The Administrator will consider determining whether the CDL program of a State in substantial noncompliance should be decertified.

This would mean that the State of Connecticut would be prohibited from issuing Commercial Driver’s Licenses (CDLs). Not only does that mean there would be no new truck drivers in Connecticut, it means that those currently holding CDLs in Connecticut would not be able to renew them. Ultimately that would mean there would be no truck drivers from the State of Connecticut. There are currently about 12,700 truck drivers from Connecticut.

I can understand the argument that “it’s not fair” that one person can go through a pre-trial diversion program if they get arrested for DUI in a passenger car, but their neighbor who does the exact same thing cannot, simply because they have a CDL. However, being a truck driver is a very important job that comes with lots of responsibility. Most truck drivers recognize that they are held to a higher standard than other drivers, and that standard is something that comes with the job. That standard comes with the job because highway safety is an absolute priority to the trucking industry. Because the industry prioritizes safety, it cannot support a policy that would hide the drunk driving arrests of its drivers. This is especially true regarding drunk driving arrests that would be incurred by people who are not of legal drinking age, which is what this bill would do.

In order to prioritize safety, and preserve Connecticut’s receipt of federal highway funds, I urge rejection of this proposal.

About the Connecticut Trucking Industry

- 85.8%: number of Connecticut communities that depend exclusively on trucks to move their goods

- 98%: percent of manufactured tonnage transported by truck in Connecticut

- $3.4 billion: total trucking industry wages paid in Connecticut (2018)

- 61,590: trucking industry jobs in Connecticut (2018)

- $55,777: average annual salary in Connecticut (2018)

- $9,026: average annual CT-imposed highway user fees paid by tractor trailers (as of 1/1/2020)

- $8,906: average annual fed-imposed highway user fees paid by tractor trailers (as of 1/1/2020)