Legislative Alert: Gov. Lamont again proposes taxes targeting trucking

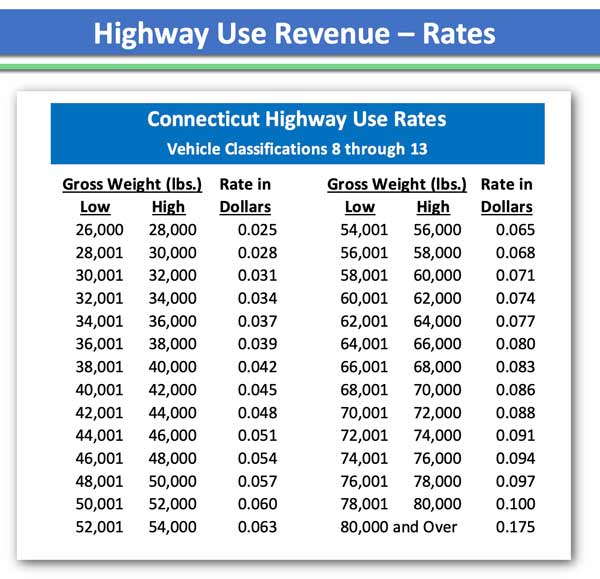

Connecticut Governor Ned Lamont has announced multiple legislative proposals which target the trucking industry. One is a new mileage tax known as the Highway Use Tax (HUT). The Connecticut HUT will be imposed specifically on classifications 8 through 13, which means tractor trailers. Here are the proposed rates for the tax, based on the weight…

Connecticut Governor Ned Lamont has announced multiple legislative proposals which target the trucking industry. One is a new mileage tax known as the Highway Use Tax (HUT). The Connecticut HUT will be imposed specifically on classifications 8 through 13, which means tractor trailers. Here are the proposed rates for the tax, based on the weight of the truck.

Your businesses would be asked to submit monthly payments to the Department of Revenue Services for this tax, though it would be on the “honor system,” according to his administration.

Additionally, Lamont is asking the legislature to approve the Transportation Climate Initiative (TCI), which would increase the cost of fuel by 17 cents per gallon in the first year of its existence, and then increase from there over a 10 year period.

MTAC needs members to help fight back through the following ways:

- Do your best to calculate how much the Highway Use Tax would cost your business annually. This could involve a rough calculation of the rate shown in the table above, times the number of miles driven in Connecticut. Do this for every truck in your fleet.

- Calculate the average annual cost of TCI. This calculation should be derived from your fleet’s average annual miles driven in Connecticut, times 0.17.

- Let your State Reps and Senators know what these taxes would cost your business. If you aren’t sure who they are, check at this website.

- Let MTAC’s Joe Sculley know your costs and/or if you need talking points/feedback reaching out to your Reps and Senators by contacting Joe via email.