Carbon tax testimony

This week, MTAC President Joe Sculley submitted testimony in opposition to a bill that would establish a carbon tax in Connecticut. His testimony stated that he used information from ATA and ATRI to calculate potential costs to the CT trucking industry. In the testimony, he referenced an explanation from ATA which said, “If transportation fuels…

This week, MTAC President Joe Sculley submitted testimony in opposition to a bill that would establish a carbon tax in Connecticut. His testimony stated that he used information from ATA and ATRI to calculate potential costs to the CT trucking industry.

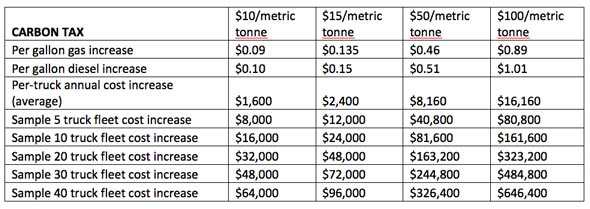

In the testimony, he referenced an explanation from ATA which said, “If transportation fuels were to be assessed a $10/metric tonne carbon tax, gasoline and diesel costs would increase by $.09/gallon and $.10/gallon respectively; at a $50/metric tonne tax, gasoline and diesel fuel costs would increase by $.46/gallon and $.51/gallon respectively. At a tax rate of $100/metric tonne of carbon, consumer fuel prices would increase by $.89/gallon and $1.01/gallon for gasoline and diesel respectively.”

Separately, the American Transportation Research Institute (ATRI) estimates that the average 18-wheel tractor trailer uses about 16,000 gallons of diesel fuel each year.

Based on those numbers, below is a table showing what cost increases could be in store for Connecticut-based small business trucking companies if this bill passes.

A copy of MTAC’s testimony is available here.